SEC Releases Fiscal Year 2022 SEC Enforcement Statistics: Trends & Takeaways

2022年11月22日The US Securities and Exchange Commission recently released its enforcement statistics for fiscal year 2022. In this LawFlash, we discuss trends and takeaways on what was an active year for the Division of Enforcement.

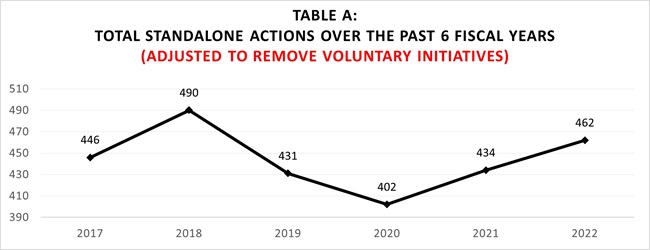

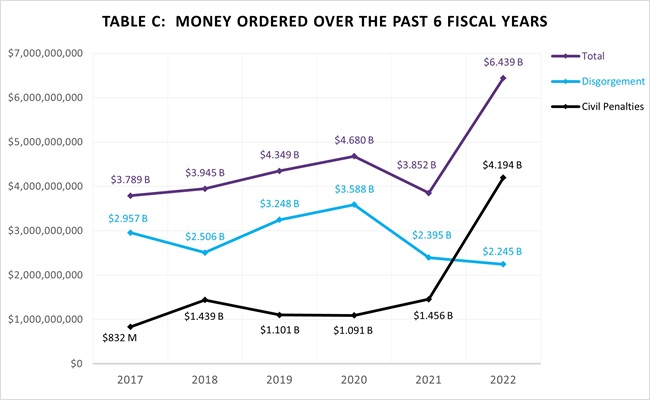

The US Securities and Exchange Commission (SEC or Commission) announced its enforcement statistics for fiscal year 2022 (FY22) on November 15, 2022, in a press release (2022 Enforcement Release) and accompanying Addendum (Statistics). The Division of Enforcement (Enforcement) filed 760 total enforcement actions in FY2022.[1] Of the total, 462 were standalone enforcement actions, including both administrative proceedings and civil actions.[2] Enforcement activity resulted in total money ordered of $6,439,000,000 during the fiscal year, including civil penalties, disgorgement and prejudgment interest in SEC actions.[3] This marked an increase of $2,587,000,000 over the previous year and set a record for the highest total recorded in SEC history.[4]

A few overarching themes from Enforcement:

- A Belief in the Power of Penalties: While professing that success is more than just numbers, Enforcement highlights a substantial increase in civil penalties and the intention to continue this trend as a form of deterrence.

- A Focus on Individual Liability: Enforcement will continue to focus on individuals, particularly those who it perceives to be gatekeepers.

- Sweeps Are Here to Stay: Broad Enforcement sweeps similar to the recent off channel communications cases are here to stay, and more are likely in the future because such investigations are viewed by Enforcement as maximizing effect while promoting internal efficiency.

- Cooperation Must Be Measurable: While cooperation credit is available in certain circumstances, those seeking cooperation should think early and tactically about how to best position for such credit at the conclusion of the Enforcement process.

TRENDS & TAKEAWAYS

Increased Enforcement Activity Despite Limited Resources

The total number of enforcement actions brought in FY22 represents a 9% increase in enforcement actions overall and a 6.5% increase in standalone actions compared to fiscal year 2021 (FY21).[5] The numbers reflect a two-year upward trend in the number of standalone enforcement actions brought by the SEC. The trend demonstrates Enforcement’s efforts to maximize its limited resources through initiatives such as investment in and use of data analytics.

Staff members continue to work remotely, and based on the SEC’s FY23 Congressional Budget Justification report, minimal year-over-year increase in head count is expected.[6] In fiscal year 2021, there were 1,366 positions in Enforcement, and the number of positions did not change for FY22.[7] In March 2022, the SEC informed Congress that it is seeking to add 125 positions to Enforcement for fiscal year (FY23).[8]

Consistent Enforcement Activity Against Certain Entity Classifications

Enforcement filed 301 of the 462 standalone actions against three classifications of regulated entities—investment advisers and investment companies (119), securities offerors (106), and entities responsible for issuer reporting, audit, and accounting work (76).[9] These top three entity classifications are consistent with Enforcement’s focus and approach in FY21.[10] The steady number of actions against entities and individuals responsible for issuer reporting, audit, and accounting work is consistent with the Enforcement’s statements, including in the 2022 Enforcement Release and throughout the year, that it is focused on “gatekeepers.”[11]

Aggressive Approach on Civil Penalties

Civil penalties tend to fluctuate from year to year, but the $4,194,000,000 reported in FY22 is almost triple the amount of civil penalties ordered in FY21 and is more than the civil penalties ordered over the last three years combined.[12] This stark increase reflects a more aggressive approach to remedies by the Commission for “deterrent effect.”[13] On November 15, 2022, Enforcement Director Gurbir Grewal alerted the industry during a speech at the Securities Enforcement Forum in Washington, DC that we should expect the Commission to continue to seek significant civil penalties in FY23.

Reduction in Disgorgement

The amount of disgorgement ordered in FY22 is the lowest amount it has been in the past six years and represents a 6% decrease from FY21.[14] It is not entirely clear why there has been such a decrease, but it may be related to the US Supreme Court’s decision in Liu v. SEC (Liu Decision).[15] There, the Court limited the SEC’s ability to seek disgorgement as a form of equitable relief under Section 21(d)(5) of the Securities Exchange Act of 1934 to instances where the disgorgement award does not exceed a respondent’s net profits and is granted for the benefit of those harmed.[16]

The Liu Decision may be causing the SEC to view disgorgement differently than it has in the past. Although it is too early to fully understand this trend, it emphasizes the importance of focusing on each remedy sought by the Commission, and the need to consider how the practical effects of decisional law and Enforcement’s focus interplay.

Increased Focus on Undertakings

The SEC is increasingly seeking and securing undertakings in settled administrative proceedings. According to the 2022 Enforcement Release, “tailored undertakings” may be used as “potential roadmaps for compliance by other firms” and are imposed so entities may remediate issues, review policies, procedures, and controls, and enhance compliance with securities laws and regulations.[17] Such undertakings, however, present additional costs to entities resolving matters with the Commission and constitute a significant additional administrative burden for those entities.

SOX 304 Clawbacks for Uncharged Executives

The 2022 Enforcement Release asserts that holding individuals accountable “is a pillar of the SEC’s Enforcement program,” noting that more than two-thirds of the standalone enforcement actions brought in FY22 involved one or more individual respondents or defendants.[18]

The SEC also notes, however, that it utilizes Sarbanes-Oxley (SOX) 304 to charge senior executives at public companies—who are otherwise uncharged—to effect clawbacks of their bonuses and compensation following misconduct that occurred at their companies.[19] The SEC has repeatedly emphasized its ability to utilize SOX 304 as a tool during various speaking engagements throughout the year, so more clawbacks are likely in FY23.[20]

Improved Efficiency Through Use of Data Analytics

In years past, the SEC has spoken at length about utilizing data analytics.[21] For example, in October 2021, SEC Chairman Gary Gensler commented that “[p]redictive data analytics, including machine learning, are increasingly being adopted in finance” and opined that this development “could be every bit as big as the internet was in the 1990s.”[22] The SEC’s repeated mention of the topic forecast increased use of data analytics during FY22, and this apparently came to pass..

The 2022 Enforcement Release notes that Enforcement utilized “sophisticated analytic work” to aid in a variety of enforcement actions.[23] The Commission is likely to continue using data analytics in all types of cases because it increases efficiency and allows the SEC to target conduct that might otherwise go undetected.

Industry Sweeps

The SEC obtained $1,235,000,000 in cumulative penalties in connection with its industry sweep for recordkeeping violations related to personal devices in FY22.[24] Director Grewal asserted in his speech on November 15, 2022, that the industry can expect more sweeps going forward. This is likely because sweeps are an efficient and effective use of Enforcement’s limited resources, as sweeps allow the Commission to develop a single theory and legal construct and then apply it to multiple regulated entities. Although the Division of Examinations will likely be looking for similar issues, expect to see more direct-to-enforcement investigative sweeps by Enforcement in FY23.

High Plateau of Whistleblower Tips

The SEC received over 12,300 whistleblower tips during FY22, which is “a record high.”[25] While this number represents approximately 100 more tips than the previous fiscal year, the statistic is significant because it reflects a plateau in tips at a high quantity compared to the amounts of tips received prior to FY21.[26] Whistleblower tips are significant to the SEC because they often alert Enforcement to conduct that it might not otherwise have detected, and whistleblowers can provide an insider’s view and account of alleged violations that can greatly aid Enforcement in its investigation.

Whistleblower Awards Remain High

In FY22, the SEC issued approximately $229,000,000 in awards to 103 whistleblowers.[27] This is less than half of the $564,000,000 that was awarded to 108 whistleblowers in FY21.[28] However, FY22 marks the SEC’s second-highest year in terms of award amounts and number of award recipients.[29] Therefore, while there has been some fluctuation in award amounts, whistleblower awards remain at an all-time high.

CONCLUSION

Enforcement was very active in FY22, increasing the number of overall filed actions. The SEC maximized the effect of the actions resolved during the fiscal year by seeking undertakings, aggressively pursuing civil penalties, and obtaining the highest amount of money ordered in SEC history. The increased enforcement activity followed the road map laid out by the Commission statements throughout the year.

Morgan Lewis will continue to closely monitor the SEC’s announcements and statements and identify industry trends.

Contacts

If you have any questions or would like more information on the issues discussed in this LawFlash, please contact any of the following:

[1] Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2022 at 1 (Nov. 15, 2022).

[2] Id. at 1-2; see also Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[3] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[4] Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2022 at 2 (Nov. 15, 2022); see also Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[5] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[6] Securities and Exchange Commission, Fiscal Year 2023 Congressional Budget Justification Annual Performance Plan (Mar. 25, 2022).

[7] Id. at 16.

[8] Id. at 6, 19, 25.

[9] Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2022 at 1 (Nov. 15, 2022).

[10] Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2021 at 1 (Nov. 18, 2021).

[1] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022); see also Grewal, Gurbir, Director of SEC Division of Enforcement, Testimony on “Oversight of the SEC’s Division of Enforcement” Before the United States House of Representatives Committee on Financial Services Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets (Jul. 21, 2022).

[12] Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2022 at 2 (Nov. 15, 2022).

[13] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[14] Id.; Securities and Exchange Commission, Addendum to Division of Enforcement Press Release Fiscal Year 2022 at 2 (Nov. 15, 2022).

[15] Liu v. Sec. & Exch. Comm'n, No. 18-1501, 2020 WL 3405845 (June 22, 2020).

[16] Id. at *2.

[17] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[18] Id.

[19] Id.

[20] See, e.g., Securities and Exchange Commission, Remarks at SEC Speaks (Sept. 9, 2022).

[21] See, e.g., Prepared Remarks at SEC Speaks (Oct. 12, 2021).

[22] Id.

[23] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[24] Id.

[25] Id.

[26] See Securities and Exchange Commission, Whistleblower Program 2021 Annual Report to Congress at 2 (Nov.

15, 2021).

[27] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).

[28] Securities and Exchange Commission, Whistleblower Program 2021 Annual Report to Congress at 10 (Nov.

15, 2021).

[29] Securities and Exchange Commission, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022).