FTC Merger Enforcement Shows Bipartisan Trends Under Different Presidential Administrations

January 02, 2025The 2024 US election cycle underscored the strong and varied views of the American electorate. However, there is at least one federal government agency where Republicans and Democrats have seen eye-to-eye more than many might expect: the Federal Trade Commission (FTC).

While there have been several policy disagreements among Republican and Democrat FTC Commissioners in recent years, most merger enforcement actions have remained a bipartisan endeavor—and not just with respect to Big Tech cases. While Republican FTC Commissioner Andrew Ferguson, who was nominated by President-elect Donald Trump to be the next FTC Chair, is expected to be substantially more business-friendly than his predecessor, he voted with his Democratic colleagues to block multiple mergers as an FTC Commissioner, including Tempur Sealy’s acquisition of Mattress Firm and Tapestry’s acquisition of Capri.[1]

Below, we compare how Democratic and Republican FTC Commissioners voted on FTC merger enforcement actions (as defined below) under both the Trump-Pence administration (2017–2020) and the Biden administration (2020–2024), revealing a surprising degree of convergence.

BIPARTISAN ALIGNMENT ON MANY COMPETITIVE HARMS

Across both the Trump-Pence and Biden administrations, the political party affiliation of Commissioners has not led to significant differences in voting for merger enforcement when analyzing enforcement rates in the aggregate.

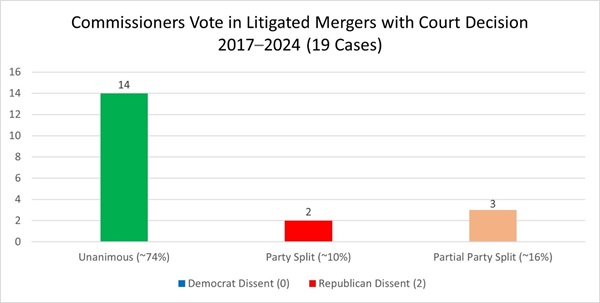

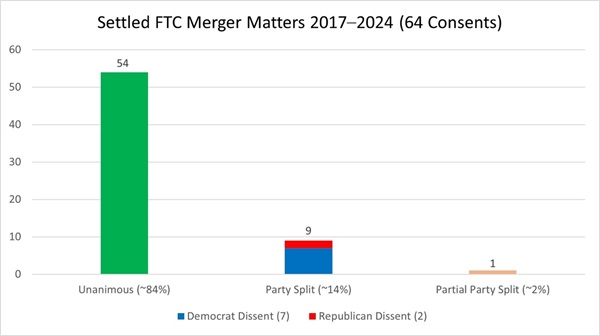

In Figures One and Two below, the Commissioners' votes on merger enforcement were split into three categories: Unanimous Votes, Party Splits, and Partial Party Splits. Unanimous votes are those in which all Commissioners, regardless of political party, voted in favor of the action. Party Split votes are those in which Commissioners voted along party lines and against the other party. Partial Party Splits are those in which at least one Commissioner voted against another of the same political party.

For purposes of this article, Enforcement Action refers to instances where

- the FTC files a complaint in administrative or federal court and the merging parties settle with the FTC (pre- or post-litigation) (consent order);

- where the parties abandon the deal post-complaint; or

- where the complaint results in a court decision (e.g., preliminary injunction denied).

As shown below, both Republican and Democratic FTC Commissioners voted unanimously when voting to pursue litigation to block mergers or enter consent orders (~74% and ~84% of all such cases, respectively). [2]

Figure One

Figure Two

Commissioner Disputes Appear to Focus on Enforcement Action Type, Not Necessity

Democratic and Republican Commissioners typically split their vote with respect to the type of enforcement warranted, rather than whether enforcement was warranted at all. Of the 11 party splits (two in litigation and nine as settlements) in the Trump-Pence and Biden administrations, more than half of the involved Commissioners unanimously agreed to bring an Enforcement Action, with Democratic Commissioners dissenting later to the consent order because they did not think it went far enough to preserve competition. Only four party splits involved a dissenting vote as to whether to bring the Enforcement Action altogether, with all such dissents involving Republican Commissioners.[3]

BIPARTISAN AGREEMENT ON INDUSTRY TARGETS

Another way both the Trump-Pence and Biden-era Commissioners were consistent was in their enforcement priorities concerning various industries. Life sciences transactions accounted for the largest percentage of enforcement actions (~36%) under both administrations. However, consistent with their preferred enforcement types discussed above, Republican Commissioners under the Trump-Pence administration voted for settlements when challenging life sciences transactions, while the Democratic Commissioners dissented and encouraged the FTC to litigate and/or expressed dissatisfaction about the adequacy of settlements to preserve competition in the alleged life sciences markets.[4]

Similarly, both President Joseph Biden and President-elect Trump have expressed concerns relating to Big Tech. Transactions in life sciences and technology will likely continue to face scrutiny under the incoming Trump-Vance administration.

THE FUTURE OF THE COMMISSION

In most merger Enforcement Actions, we do not expect the new FTC Chair to disrupt the general alignment of Republican and Democratic commissioners discussed above, although we may see a return to more use of settlements and the modification of some Biden-era policies and practices objected to by prior Republican Commissioners.

Over the next four years, it is possible that the extent of M&A activity will primarily be driven by macroeconomic factors (e.g., interest rates and pent-up demand by America’s large M&A infrastructure), geopolitical dynamics, and US ingenuity, and only secondarily by actual or perceived lessening of government enforcement at the Commission.

HOW WE CAN HELP

Morgan Lewis has assembled a cross-disciplinary bipartisan team of lawyers who are former government agency officials and regularly represent clients before all federal agencies, including executive agencies (the Departments of Justice and Education, Consumer Financial Protection Bureau, Federal Trade Commission, Equal Employment Opportunity Commission, and US Securities and Exchange Commission), and congressional committees and inquiries. Our team is primed to help clients navigate the post-election landscape by providing executive order analyses and updates on key agency developments and regulations and will develop programming and guidance regarding legal and business developments in the weeks and months to come.

STAY INFORMED

Visit our US Administration Policies and Priorities resource center and subscribe to our mailing list for the latest on programming, guidance, and current legal and business developments involving the Trump-Vance administration.

Contacts

If you have any questions or would like more information on the issues discussed in this LawFlash, please contact any of the following:

[1] See FTC Moves to Block Tempur Sealy’s Acquisition of Mattress Firm (July 2, 2024); FTC Moves to Block Tapestry’s Acquisition of Capri (April 22, 2024).

[2] Litigated mergers are those in which the merging parties defend the transaction in administrative or federal court against the FTC and did not abandon or settle. The date of inclusion is based on the calendar year and not the fiscal year of the FTC. Figures One and Two did not include matters where the Commission consisted of Commissioners from only one party.

[3] These include some of the highest-profile merger enforcement actions in recent years, such as the FTC’s challenges to the Meta/Within and Microsoft/Activision mergers.

[4] See, e.g., “Dissenting Statement of Commissioner Rebecca Kelly Slaughter in the Matter of AbbVie and Allergan,” Commission File No. 191-0169 (May 5, 2020).